Joshua

4.90

United States

Whitney

4.90

Australia

Nikola

4.80

United States

Alana

4.80

United Kingdom

Choose your own tutor

Choose your own tutor

Choose the tutor that has the personality, professional experience, or focus area you need!

Pick the plan that works for you

Pick the plan that works for you

Try our free resources

Get a taste of Cambly with our most popular tools and guides. No subscription required.

Try our free resources

Get a taste of Cambly with our most popular tools and guides. No subscription required.

Courses for every skill level and interest

Courses for every skill level and interest

Focus on your specific goals with our guided courses, including academic test prep, business English, conversation practice, and more.

"What I like about Cambly is that all the tutors are native English speakers and their high teaching quality. My English has improved a lot and I am having fun studying it!"

Shoji

Japan

"After using Cambly, I seldom have a situation where I am so nervous that my hands shake when I speak English. I used to be afraid of speaking English, and I was always afraid that I wouldn't speak well enough for others to understand, but now I am much better!"

Xinrui Liu

China

"I have experienced a growth in my confidence as an English-speaker, with a host of idioms now at my disposal. No matter where you come from or who you are, Cambly will be your best companion on journey toward better English"

Khalid Al Ghareeb

Kuwait

Achieve your goals by learning English with Cambly

Achieve your goals by learning English with Cambly

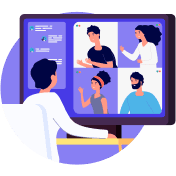

New! Group Lessons

A fun way to practice English, guided by a native English-speaking Cambly tutor.

For organizations

Empower your team with practical, real-world English skills they need to excel in global business.

For kids

Unlock your child’s global future with lessons filled with fun and games that have them speaking English from day 1.

Become a tutor

Become a tutor

Join our English tutoring community to enjoy flexible scheduling and rewarding conversations with people from all over the world.

Join our English tutoring community to enjoy flexible scheduling and rewarding conversations with people from all over the world.